Retention Rate and Churn Rate: All You Need to Know

In any business today, customer retention is one of the most important indicators of business health. Retention rate refers to the percentage of customers that a business is able to retain over a given time period and tends to be one of the most important metrics for today’s business leaders to understand and optimize. The churn rate (also referred to as the attrition rate), on the other hand, is an indicator of the rate at which customers elect to stop doing business with an organization. In other words, it's the percentage of customers that discontinue their service over time. A high retention rate naturally indicates a low churn rate.

The importance of the retention rate and churn rate can be well articulated with a simple sentence: growing is not the same as gaining.

Customer retention is foundational to long-term success, especially in the SaaS industry. A strong focus on retaining and monetizing the customers or users that you already have is a much more sound strategy than one of pure acquisition with volatile retention.

Put simply, customer retention is a feedback metric that helps you understand how the decisions you make directly affect your business as well as how effective your product, your marketing efforts, and your customer service is. It's therefore helpful to ask: how are the changes we make at the business level influencing the ways in which our customers either churn or renew?

When customers are retained in the long-term, it means you’re doing something right. When they churn, you should try to understand the why so that you can make a change to prevent similar experiences in the future. Understanding your churn rate naturally lends itself to an understanding of how sticky your business is; high churn means high revenue churn and a significant impact on your bottom line.

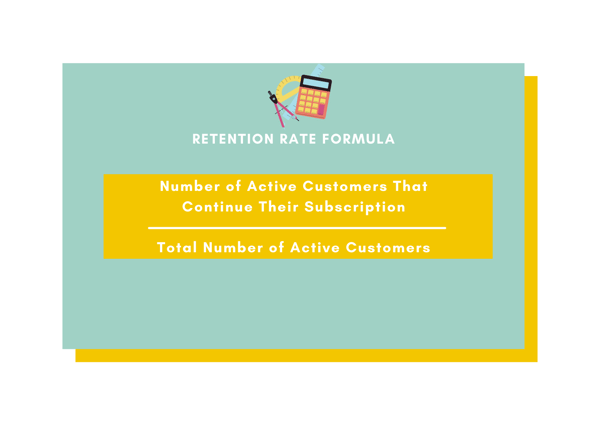

How to calculate your retention rate?

To calculate your retention rate, divide the active customers that have elected to continue their service with you at the end of a given time period by the total number of active customers you had at the beginning of that same time period.

Here's what the formula looks like:

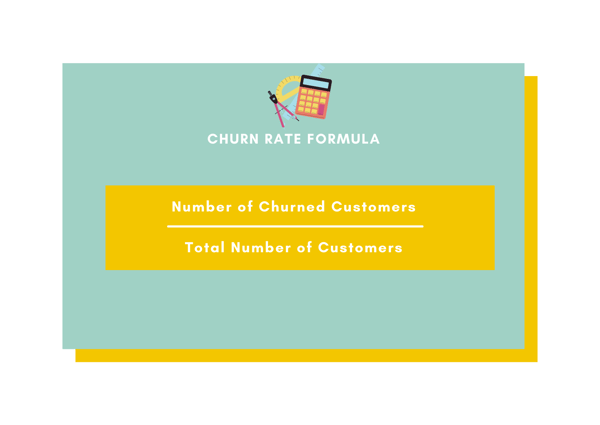

How to calculate your churn rate?

To calculate your churn rate, simply divide the number of churned customers divided by the total number of customers in a given time period.

Here's what the formula looks like:

While these calculations are simple enough in nature, there are several factors to be aware of that can quickly complicate things. That’s why it's important to, if you really want to be data-driven, standardize the manner in which you calculate churn so that you're left with a meaningful analysis over time.

First, make sure that you're counting the total customers you have in a consistent manner (this figure changes frequently throughout a week, month or year with new signups; customers could have signed up prior to a given period, during the period, or churned during that period).

Then, make sure you understand when churn actually happens for you. Is it at the end of the subscription period when a renewal doesn’t happen ? Is it at the moment someone cancels their service? Is it something else entirely?

Furthermore, make sure you understand the limitations of the churn rate. If you’re in a hyper-growth phase, for example, you likely have very limited data to go off of. Imagine you’ve had one customer churn out of the ten active customers you have; it's unlikely that this 10% churn rate will remain the same when, fast forward a year, you have 500 customers.

What’s more is that the timeframe over which you evaluate your churn rate significantly influences the figure; churn rates differ drastically when, for example, evaluated from a month-to-month vs. a year-to-year perspective.

There are a number of other things to consider here: seasonality, different characteristics for different customer types, and so on. Fortunately, the fundamentals remain the same: apply your churn rate calculation consistently so that you can compare not only from month-to-month but year-to-year as you grow.

Is retention more important than acquisition?

The answer might be frustrating: maybe.

Customer acquisition is important, don't get us wrong. Yet companies that focus too much on new customer acquisition, and not enough on keeping their existing customer base around, are actually more likely to (drastically) underperform.

Those that actively try to increase their retention rate and subsequently decrease churn are far more likely to see sustained success.

Retention rates are dynamic. That means that it's important that you pay constant attention to the calculation, analysis, and optimization of them. Having dashboards that enable you to understand the nuances of customer retention are a surefire way to ensure that you’re able to collect and make use of the valuable feedback you’re getting from your customers.

How to reduce churn and improve retention

There are loads of tactics that any company can employ to reduce churn and improve retention. Here are some highlights:

- Service first: how is your customer service? Take an honest look at the operations of your customer success function. Is it easy for customers to reach out for help? What is the wait time for issue resolution? There's likely always something you can do to improve your customer service.

- ...and what about onboarding? Tying into our first point, ease-of-onboarding is one of the most critical elements to retaining customers in the long term, especially in the age of the dreaded "opt-out" clause. Make sure that your customers have access to support, that your employees are well trained, and that you understand where you can (continually) improve the process.

- Take a serious look at the renewal process: just how easy is it for your customers to renew? Is the process overly manual? Are they informed of the renewals well in advance? Everyone today seems to be busy. Make this task as painless as possible for your customers!

- Listen! Listening, both to your customers and prospects, is a great way to learn more about the specific pain points that they're experiencing: both the ones that you're able to solve, and the ones that you could solve. People just want to be heard: listen, and reap the rewards.

- Track: this is probably obvious by now, but tracking retention and churn metrics as early and often as possible is important.

Want more? SuperOffice has some great tips for reducing churn as well.

The impact of guided analytics on retention and churn

We've hopefully, by now, driven home the fact that having a clear, easy-to-use, easy-to-access view of retention and churn analytics is vital if you want to improve these metrics at your organization.

The unfortunate truth, however, is that despite an explosion in analytics spending today, users aren't getting the value they expected. This is largely because, in our attempt to make analytics fast, powerful, all-seeing, and all-knowing, we've also made them incredibly hard to use. So complex that only experts can make full use of analytics.

That means that we must make analytics easier for business people, and that's our vision: guided analytics that assist users in understanding data and using that data to collaborate and drive results. Check it out: