Customer lifetime value, often called CLV or LTV, is defined as the monetary value of a customer to a business and is an important metric to understand how profitable a company can be or how much it can potentially spend to acquire new customers. Identifying the value of a customer can be helpful to a company's marketing budget, resources, profitability, and forecasting. Subscription-based business models use it in conjunction with MRR (Monthly Recurring Revenue).

Why is customer lifetime value so important?

Each individual customer generates a certain amount of business value, which is the customer lifetime value. Therefore, CLV is used to determine whether your customer relationships are profitable. Marketers, advertisers, and sales teams use CLV to determine how much they can spend on acquiring, engaging, and retaining customers while still being profitable. However, before you calculate CLV, there are a few other things you should know:

- Average Purchase Value

This is the average value of a customer transaction.

- Average Gross Margin

This tells you what part of each customer purchase is profit and what part is cost. Average gross margin can be calculated with the following formula:

Gross Margin = (Total Revenue – Cost of Sales) ÷ (Total Revenue)

- Purchase Frequency

This is the average number of transactions a customer makes over a given time period (usually a year). You can calculate the frequency of purchases by dividing the average number of purchases by the average number of customers.

- Customer Lifespan

This is the length of a typical customer relationship. To make calculations easier, this is generally measured in multiples of the same period as the purchase frequency. Improving customer lifespan is often a very effective way to improve your CLV.

- Customer Acquisition Cost

Customer acquisition cost, often called CAC, is the average amount you spend on acquiring a customer and includes everything from marketing and advertising to sign-up incentives.

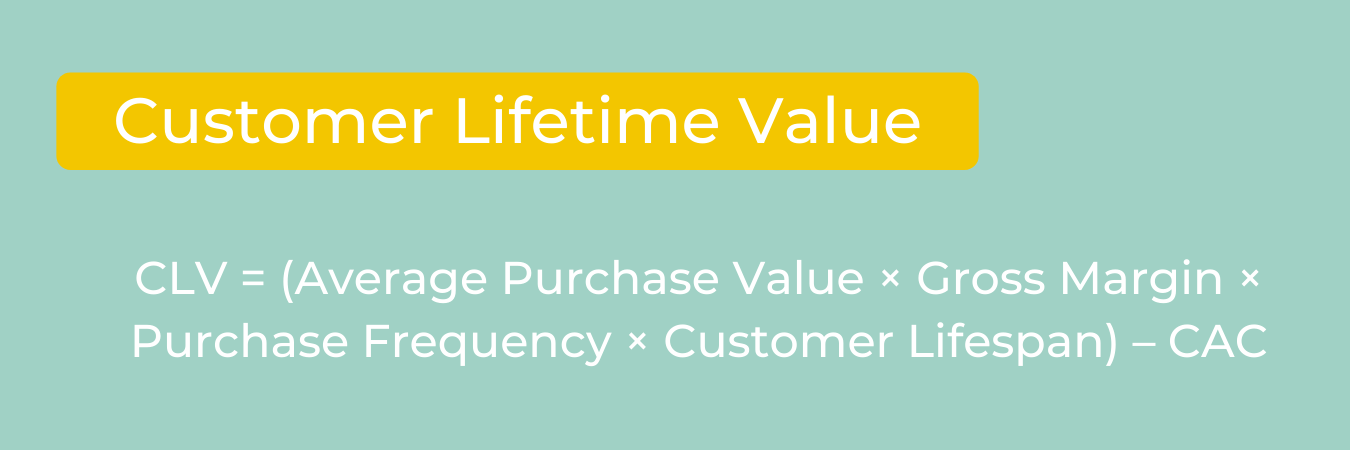

How do I calculate customer lifetime value?

Using the above information, you can easily calculate CLV. Multiply your average purchase value by your average gross margin, your average purchase frequency, and your average customer lifetime. Then deduct your acquisition cost.

CLV = (Average Purchase Value × Gross Margin × Purchase Frequency × Customer Lifespan) – CAC

For example, if your product is a $20 a month subscription service with an average gross margin of 50% and you spend $10 to acquire a customer with a lifespan of 24 months your customer lifetime value calculation would look like this:

CLV= ($20/month × 0.5 × 12 months/year × 2 years) – $10 = $230

Calculating CLV with more accuracy

If you break down your CLV further, you can perform more advanced CLV analyses, and find the right user cohorts or product SKUs to focus on, determine how much to spend on acquisition, and more.

- Calculate CLV by cohort

Cohort analytics allows you to identify user behavior across the user lifecycle by grouping users based on characteristics or experiences in order to better understand their behavior. You can identify which users to target by breaking down your CLV by cohort.

- Calculate net present value (NPV) of your CLV by using a discount rate

CLV is calculated assuming your customers generate an average amount of revenue and profit each month or year. However, the revenue and profits you receive in the future will be less valuable than if you receive them today.

Taking future revenue and profits into account will tie your CLV to your current investment cost and opportunity cost. Once you have a fixed discount rate, you can calculate the Net Present Value (NPV) of your CLV by discounting profits separately for each period, or by using an online NPV calculator (or Excel).

How to Increase the LTV?

Several tactics can be implemented by businesses to boost efficiency and increase customer retention, thereby increasing their LTV:

- Communication

When a business and customer communicate openly, customers are more likely to relate to the brand. It is imperative that companies listen to feedback from their customers so that they can improve and grow. In addition, effective communication reduces churn rates.

- Re-engage customers

Engagement with customers who have previously purchased goods and services from the company is an effective way to increase lifetime value. It is especially helpful to companies with a long shelf life, as well as for enhancing brand recognition.

- Increase brand loyalty

An understanding of a company's lifetime value can help with future growth projections and increase profitability. Loyalty programs can be implemented to increase LTV.

The concept of CLV can be broken down and applied in many ways, but seeing it as a tool for acquiring as many customers as possible as cheaply as possible will lead to failure. Analyzing your CLV can help you prioritize segmentation, retention, and monetization to increase future customer profitability. Harvard Business Review points out that CLV should be used to view customers as value-creating partners rather than value-extraction targets.

To effectively monitor your CLV and other metrics you will need a great analytics solution that is easy to use and provides actionable insights to everyone in your organization. This is where Toucan steps in.