What is the real cost of losing a commercial tenant ?

.png?width=88&height=88&name=portrait_agathe_face%20(1).png)

Agathe Huez

Publié le 15.05.19

Mis à jour le 13.01.26

2 min

Résumer cet article avec :

To demonstrate their willingness to innovate, some Commercial Real Estate companies have invested in data analysis applications. The accuracy of these tools has led to a greater awareness of the costs hidden behind the loss of tenants. This article aims to quantify the negative impact of these costs on the health of your portfolio.

Tenant retention: why does it matters?

A study conducted in the CRE industry reveals that 69% of tenants never had direct interactions with their property managers. Actually, they did not even know their names…

This lack of communication contributes to a sense of dissatisfaction. To some extent, this could even motivate your tenants to leave.

Above all, this situation has a negative impact on the good health of your portfolios. Replacing a single tenant involves expenses that can be three times higher than the cost of retaining an existing tenant. It can take up to two years to compensate for the loss of income due to the departure of a tenant [1].

What costs affect your portfolio’s sustainability when you lose a tenant?

A multitude of costs is not always anticipated when a tenant does not renew his lease. Therefore, we have taken into account several expenses in our calculation method :

Vacancy loss.

Loss of vacancy refers to the loss of rent caused when a site is vacant. The higher the tenant turnover rate, the higher this expense increases. In our calculate simulation we set the rent at $1,000 per month, the turn time is 40 days.

Marketing cost.

To fill vacant commercial space as quickly as possible, you need to market it in an attractive way. These marketing expenses can increase rapidly. On average, we estimate that marketing costs about $1.00 per square foot.

Commission.

Renting a vacant space involves leasing commission. This expense is often higher when it is a new lease. Indeed, brokerage fees for a new 7-year lease are 6%, while they are set at 4% for renewal.

TI allowance.

The renewal of a lease involves negotiations to allow tenants to perform substantive work. This specific fee usually covers the renewal of the structure, walls, HVAC, electricity, plumbing, doors, windows, paint, and carpet. In CRE’s main markets, this cost represents $50 per square foot. The leasehold improvement allowance is also considered when renewing a lease, but it is generally much cheaper.

Cleaning and minor repair.

Preparing a commercial space for new renters doesn’t just take time, it costs money as well. Several hundred dollars will have to be allocated to cleaning in, painting and minor repairs that are not covered by the TI allowance. Often, there are more repairs to be done than you might have imagined, resulting in higher costs than you originally planned in your budget.

Administration Costs.

The departure of a tenant involves the handling of several administrative formalities: the coordination of repair services, the pre-selection of new tenants, the processing of rental contracts… These tasks are extremely time-consuming and involve expenses which could be saved.

In order to put in light the costs involved in replacing a tenant, we calculated the amount of money involved in replacing or keeping a single tenant :

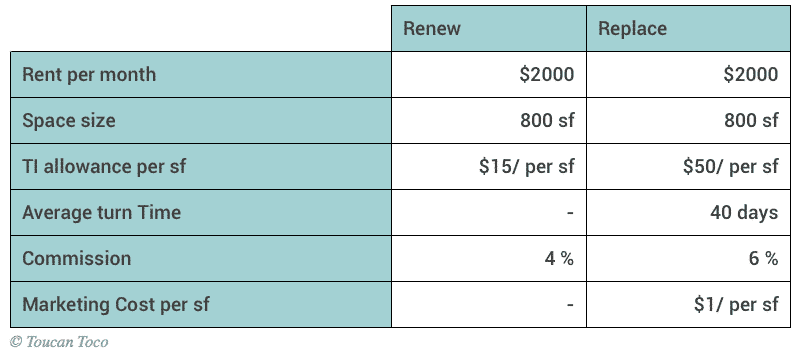

Assumption

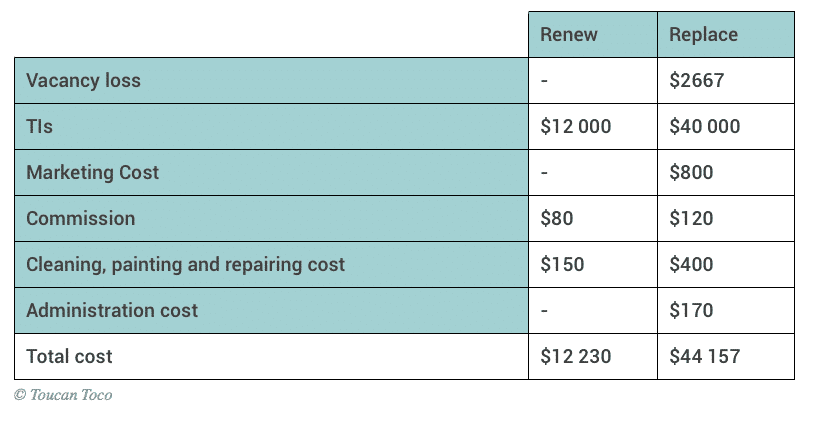

Costs

31,927 $, it is the potential cost of a tenant’s departure. A figure convincing enough to make you aware of the importance of implementing a tenant retention strategy. In Commercial Real Estate, happy tenants make a profit!

Sources : [1] Jones, Lang, Lasalle 2012, http://link.jll.com/the-cost-of-losing-a-tenant

.png?width=112&height=112&name=portrait_agathe_face%20(1).png)

Agathe Huez

Agathe is Head of Brand & Communication at Toucan, with over 10 years of experience in marketing, branding, and corporate communication, particularly in the SaaS and tech B2B sectors. An expert in brand strategy, storytelling, and public relations, Agathe helps businesses give meaning to their communication and showcase their expertise to clients and partners. She plays a key role in growing Toucan’s visibility and positioning as a leading embedded analytics solution, both in France and internationally. On Toucan’s blog, she shares insights on how to build impactful B2B brands, create memorable experiences, and turn data into a true competitive advantage.

Voir tous les articles