Total Addressable Market - what is it?

Total Addressable Market (TAM), also called total available market, is the projection of revenue if a firm achieved 100% market share. This metric helps finance and marketing firms understand the number of resources a firm should devote to a new product or service.

How to calculate Customer Acquisition Cost

This metric does not have one single mainstream calculation, which makes it difficult to calculate. Here are the three main methods for calculating TAM:

- Bottom-Up

Bottom-up analysis is the most accurate and efficient way to calculate TAM, relying on market research to provide estimates. This method takes current data on pricing and usage, taking a reasonable estimate of the businesses in their target market to attain a specific TAM.

The advantage to using bottom-up analysis is that companies can use it to explain the selection of specific customer segments. When approached by investors or public relations professionals, firms can present their data to back up their claims, instead of being left empty-handed.

- Top-Down

Top-down analysis relies on a process of elimination, utilizing numbers of a target market population and narrowing it down to specific segments. Most often, finance professionals rely on market research to most accurately estimate the TAM.

An example of top-down calculation is a firm that has created a new gaming app, targeting gamers with more expendable capital in the mobile space. Through research, the firm has found that over 70% of mobile gamers, of which there are 3 billion, spend 2 dollars or less a year on mobile games

In this case, the firm can potentially secure 900,000,000 subscriptions of 5 dollars a month. With the cost of subscriptions, the firm's TAM is $4,500,000,000

- Value Theory

The calculation of TAM using value theory seeks to provide an estimate of the value a firm's product provides and how much of it can be reflected in the price. This calculation is most commonly used when a firm introduces a new product or service to existing customers.

An example of value theory is the TAM of Lyft, a rideshare company. Lyft riders are forgoing public transport, driving themselves, taxis, and other rideshare companies. By viewing this trend, Lyft can estimate its TAM and understand how to best adjust its prices.

Why Use TAM?

This KPI can serve as a benchmark for any startup in its early phases to provide an estimate of the effort and funding needed to remain operational. This metric is especially important to firms looking to raise capital from investors or in the process of a merger. Total addressable market influences the following financial factors:

- Market Size

- Investment size

- Expected Growth

- Available Market Size

Because so many factors exist, it isn't easy to provide one streamlined calculation of TAM that will work for every firm. However, as an investor, calculating this metric can help an equity firm estimate the amount of revenue a startup can generate in a given industry.

How to Monitor TAM

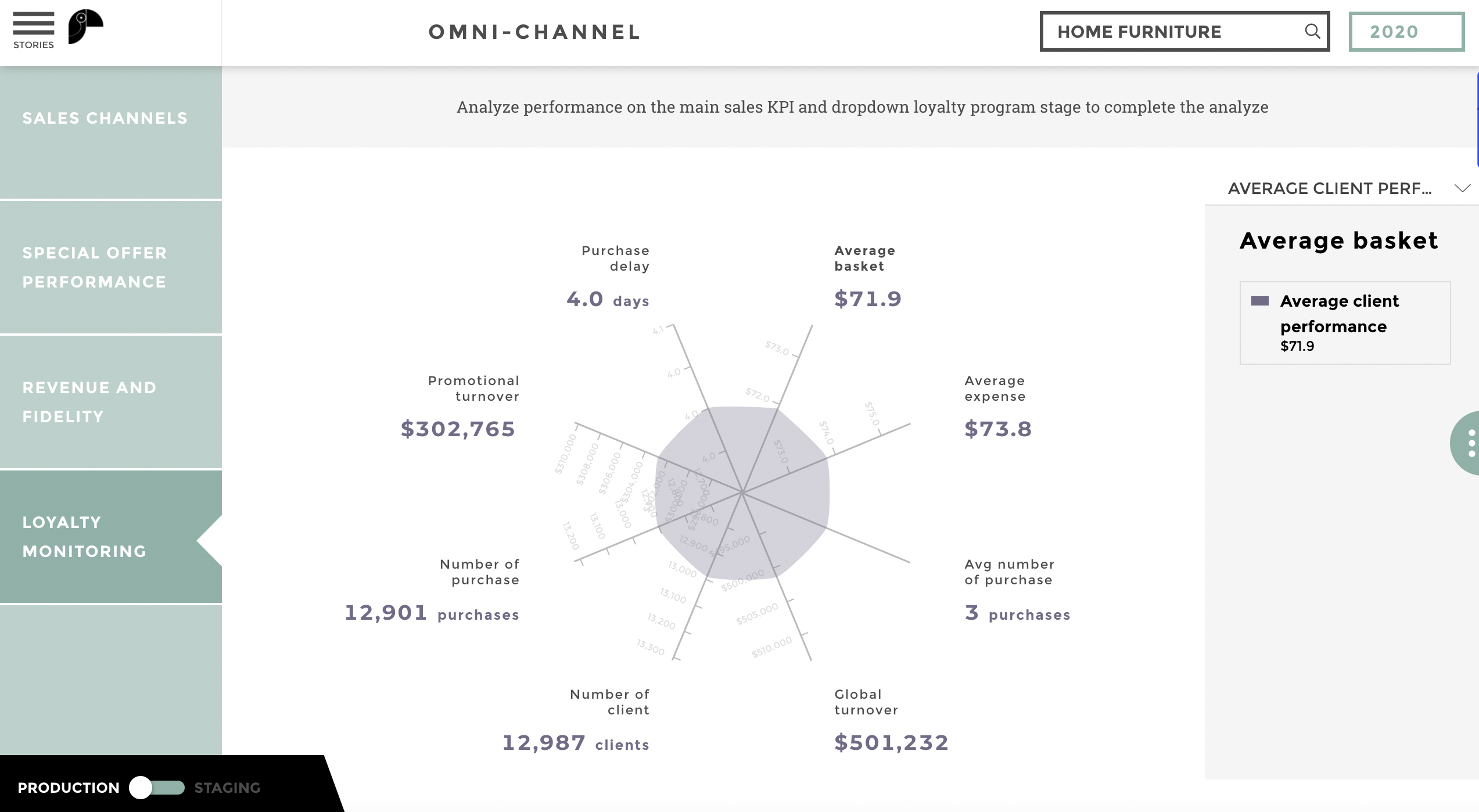

Dashboards are the clear solution to tracking this metric. With tools like Toucan that can track financial KPIs in real-time, and offer collaboration capabilities, decision-makers across customer segments can communicate about TAM optimizations and benchmarking.