Operating Cash Flow: All You Need to Know

Operating cash flow, which you may often see reflected simply as “OCF”, is a measure of the amount of cash generated by the normal business operations of a given company.

It is generally viewed as an indicator of whether or not a company can generate enough positive cash flow to maintain (or grow) its operations. If insufficient, OCF indicates that external financing is required for the expansion or continuity of those business operations.

Operating cash flow is an important financial management KPI and is something most successful teams are aware of. It’s also quite relevant for investors and shareholders who often track it to assess the health or viability of their current or future investments.

Operating cash flow is used as an important benchmark to determine financial success, and is the first section depicted on a cash flow statement (which, if you’re unfamiliar, also includes cash from any investing and/or financing activities).

Generally speaking, there are two ways to generate or reflect operating cash flow. We’ll dive into them, as well as some other key considerations for operating cash flow, on this page.

How do you measure operating cash flow?

As we mentioned, operating cash flow, to put it simply, represents the net cash an organization generates from its day-to-day business operations.

Operating cash flow is calculated using a company’s net income, and there are two widely accepted methods by which it’s assessed (using generally accepted accounting principles, or GAAP).

- The direct method: this method tracks all transactions in a given period on a cash basis and uses actual cash inflows and outflows from the cash flow statement. The direct method only covers actual paid funds, as opposed to anticipated or forecasted transactions. This includes things like employee payroll, customer revenues, revenues from investments, supplier or vendor payments, and expenses around interests or taxes.

- The indirect method: this method begins with the net income from an income statement and adds back non-cash line items to generate a cash basis figure. Put simply, the indirect method takes into account forecasted or anticipated transactions for assessing cash flow, including things like amortization and/or depreciation expenses.

How to calculate operating cash flow

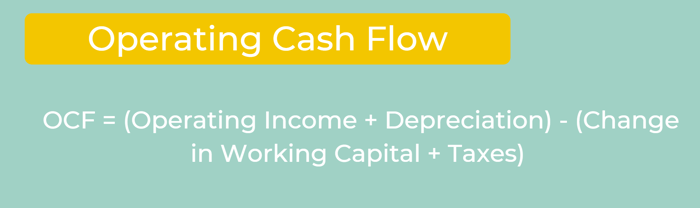

The formula for calculating operating cash flow can change to include, or exclude, a number of factors depending on the method used. One formula that you can employ looks like this:

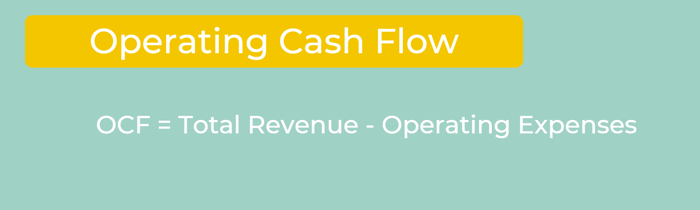

Another formula may look like this:

Ultimately, it's important to be aware of the various expenses and revenue sources that can factor into your calculations (e.g. deferred taxes, inventory expenses, deferred revenues or expenses, etc.)

The last word

At the end of the day, operating cash flow is a good way to measure the short-term financial health of a company, and is something for business leaders and finance teams to consider when setting up financial dashboards.

Investors will often analyze the operating cash flow on financial statements to assess the health and or viability of new or existing investments. A negative OCF, which indicates that a business is in need of other financing activities, would be a red flag for many established organizations (whereas a negative OCF may be reasonable to see with start-ups).