Gross Revenue vs. Net Revenue - What's the Difference?

No, gross revenue and net revenue are not the same thing!

The reporting and analysis of revenue-related Key Performance Indicators (KPIs) is vital for accounting and financing teams. Inaccurately calculating the differences between gross revenue vs net revenue, for example, can have serious repercussions on things like taxes owed.

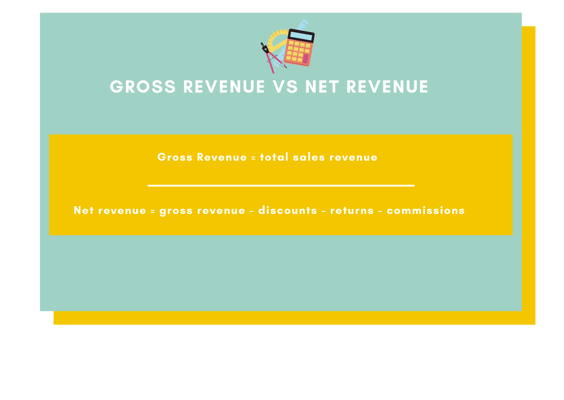

When it comes to understanding gross revenue vs net revenue, there are a few gray areas around reporting, but one of the most important things to note is that any and all earned income from sales falls into one of these categories. When recording gross revenue, teams should account for all income from a sale. That means that there are no considerations for any expenses involved in generating that sale (from any source).

When recording net revenue, on the other hand, teams should subtract the cost of goods sold from gross revenue. Net revenue, therefore, provides a more accurate understanding of a business's bottom line (see more on gross profit and net profit).

To put it simply, gross revenue is reflective of earnings before deducting expenses, and net revenue is reflective of earnings after deducting expenses.

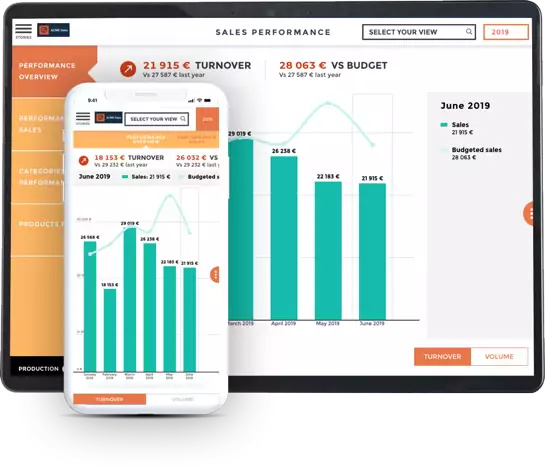

Reporting gross revenue vs net revenue

To reiterate, the main difference between gross revenue vs net revenue is that, when gross revenue is recorded, all income from a given sale is accounted for, and there are no considerations for the associated expenditure(s). Gross revenue calculations exclude the cost of goods sold, whereas net revenue computes a company’s bottom line, which is calculated by subtracting the cost of goods sold from gross revenue.

To drive this point home, let’s look at the formulas for gross revenue vs net revenue:

Net revenue is often used when a company needs to recognize commissions, or in instances where their vendors might receive a portion of their sales revenue. Understanding the difference between gross revenue vs net revenue is most often used to determine how successful a business is at two things:

- Controlling expenses

- Generating profits

Why is this important?

In addition to the reasons we mentioned above, there are a number of things that make calculating both gross and net revenue important.

As it pertains to investment, investors are often most interested in gross revenue because it's one of the strongest indicators of a business's ability to generate sales (and is therefore reflective of growth potential). Investors consider this to be one of the main profit metrics to look at when evaluating new ventures.

Net revenue is excellent to help drive data-driven decision-making. For example, if a product or service is generating high revenue figures, it is not necessarily a good thing. Net revenue shows you whether that is actually profitable.