COVID-19 has accelerated the focus on ESG in every industry, with firms across every major industry putting an emphasis on health and safety. The insurance industry is no different, with BlackRock stating that 78 percent of insurers claim that COVID-19 has accelerated their focus on ESG.

Although there is no concrete standardization of ESG for insurance providers, the industry is taking a turn towards the wide adoption of ESG. AM Best is the official ranking recognized by the U.S. Securities and Exchange Commission and the National Association of Insurance Commissioners. Since AM Best is a Nationally Recognized Statistical Organization, U.S. insurance firms abide by the metrics with which they rate the efficacy of services provided by insurance firms.

Last year, AM Best signed the United Nations Environment Programme Finance Initiative’s Principles for Sustainable Insurance, with the purpose to “better understand, prevent and reduce environmental, social and governance risks, and better manage opportunities to provide quality and reliable risk protection.”

Standardization is Near

The rating agency clearly believes that ESG is a prominent factor in assessing the credibility of insurance organizations, which promise to ensure individuals who are affected by weather-related incidents. Although ESG principles are not regulated by U.S. federal law, international law and rating organizations are indirectly pushing insurance firms to protect the environment, grow communities, and ensure ethical governance.

The Securities and Exchange Commission is currently developing a proposal that will require climate risk disclosures in annual reports, addressing disclosures about:

- Addressing climate risks and governance

- Climate targets and progress toward achieving those targets

- Greenhouse gas emissions data

Many frameworks such as the Task Force on Climate-related Financial Disclosures framework have existed to propose ESG regulations, and now these frameworks will be taken into account by the SEC to create a regulatory framework. This means that for insurance firms, which are some of the most important and trusted in society, beginning ESG KPI tracking before the regulation can provide a head start. Here are some of the most important ESG KPIs insurance firms should track.

Social

- Donations

Charitable contributions are an implied responsibility of any firm relying on the support of its bordering communities. The insurance industry is no different, with the industry contributing $560-600 million annually from 2015 to 2019. A report by McKinsey and Company found that the industry is more willing to work together toward common philanthropic goals and establish influence within their communities. Firms that track charitable contributions can greatly increase appreciation from the communities they influence. To measure this KPI, track donations as a percentage of total revenue.

- Health & Safety

Health and safety are among the primary concerns of the insurance industry, aiming to mitigate risks associated with predictable outcomes. Major insurance providers such as Progressive are offering devices to measure driving speed, incentivizing consumers who use them by offering discounts on plans. By tracking programs to increase consumer safety, insurance firms make an effort to preserve the lives of their employees while strengthening their bottom lines. The best way to track this KPI is to measure preventable incidents before and after health and safety program initiation.

Environmental

- Office Energy Consumption

Insurance firms are looking to protect the environment through building infrastructure that is environmentally sustainable. For example, Zurich is committed to building sustainable buildings that regulate lighting, heating, and cooling settings to meet the essential needs of workers. To measure this KPI, firms can install measuring instruments to track energy consumption and adjust energy-saving strategies according to insights.

- Business Travel

It is no secret that the insurance industry is global, with major firms expanding into regions across the globe. By limiting business travel through the utilization of virtual meetings, firms can greatly limit their carbon footprint by reducing emissions used by air and land travel. To measure this KPI, insurance firms can utilize a third-party firm like TerraPass to measure the carbon footprint caused by travel.

Governance

- Contribution to Political Parties

The insurance industry made significant contributions to the 2020 U.S. elections, totaling $120 million throughout the election cycle. This set a record for the industry, with no signs of slowing down any time soon. Tracking donations and reporting them can be an asset for firms who want to represent non-partisanship and credibility. The best way to measure this KPI is to track political donations as a percentage of a firm’s revenue.

- Pending Legal Proceedings

Legal proceedings are a major component of the insurance industry’s operations, with consumers litigating potential malpractice and wrongdoing. Although this is common, insurance firms should try to limit litigation as much as possible to save expenses and reduce any questions about controversial practices. To measure this KPI, track the total expenses from legal proceedings as a percentage of total revenue.

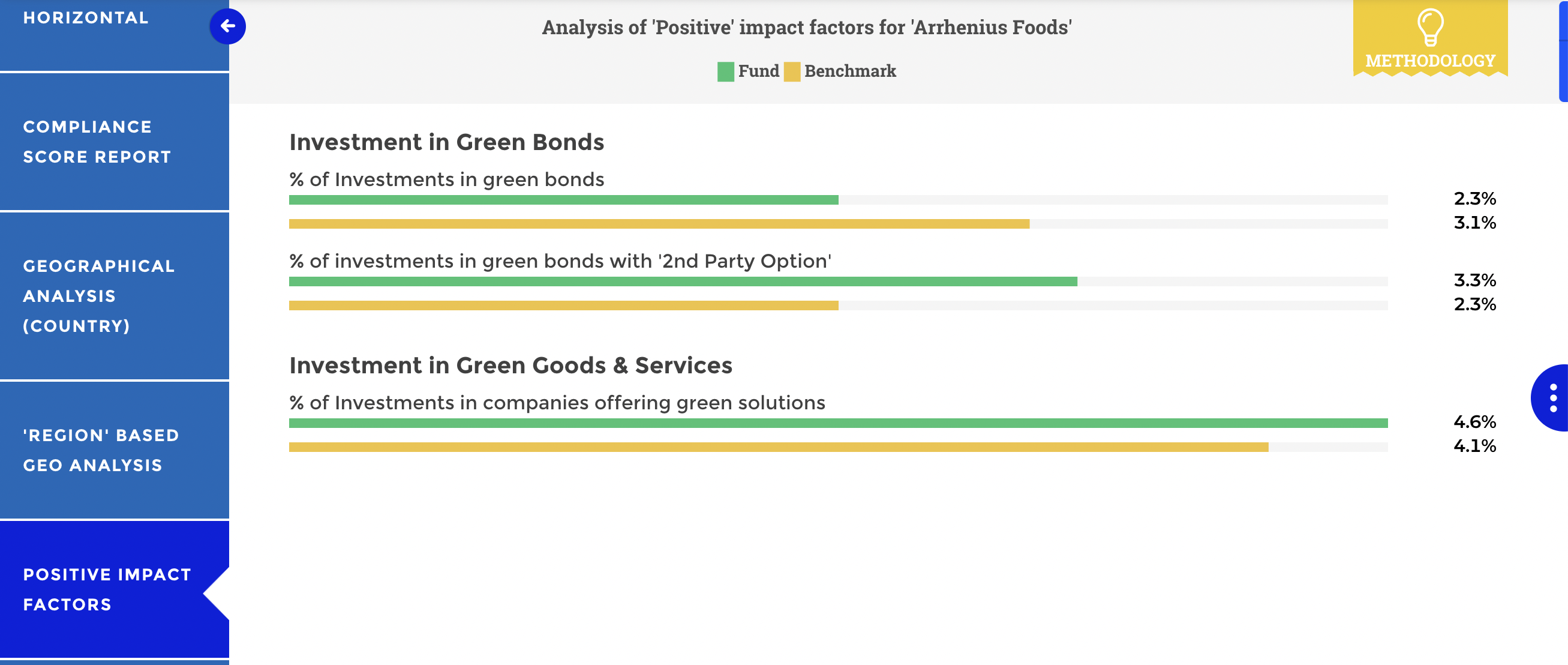

- Financial Instruments Held in Accordance with ESG Criteria

Insurance firms notoriously hold financial instruments to finance operations, holding millions of dollars in assets. Often, these investments are not made with ESG criteria in mind, leading to potential conflicts of interest and environmental damage. By instituting a robust screening system for potential investments, insurance firms can greatly reduce their risk. To measure this KPI, track the percentage of financial instruments and investment assets held in accordance with ESG criteria.

Data Visualization as an ESG KPI Solution

These KPIs all provide insight, transparency, and accountability for firms willing to abide by ESG initiatives. Tracking these KPIs is no easy undertaking and cannot be done effectively or efficiently without the right tool to track and display data.

Data visualization tools that provide high personalization, optimization, and scalability such as Toucan can make your ESG data a lot more credible, impactful, and easy to understand. By involving all employees and decision-makers in a firm’s ESG journey, all departments can easily work together to create sustainable and transparent change.

Most importantly, by displaying its ESG KPIs to all employees and consumers, insurance firms can maintain an image of credibility, justice, and non-bias. With an investment in a tool such as Toucan, which portrays data through storytelling and offers glossary functionality to help non-technical users understand data, firms can tell their ESG story in a quick, efficient, and readable manner, ultimately attracting more consumers who are unhappy with their insurance providers’ malpractice.