Recurring revenue refers to the proportion of a business's revenue that is expected to continue in the future. Recurring revenue is dissimilar from one-off sales events. Recurring revenue is more predictable and stable, as it reoccurs at regular intervals.

Recurring revenue generally leads to positive business outcomes such as higher revenue predictability, higher gross and net profit, and increased stability. When total revenue is made up largely of recurring revenue sources, teams are better able to plan and estimate their business value and are more attractive to investors.

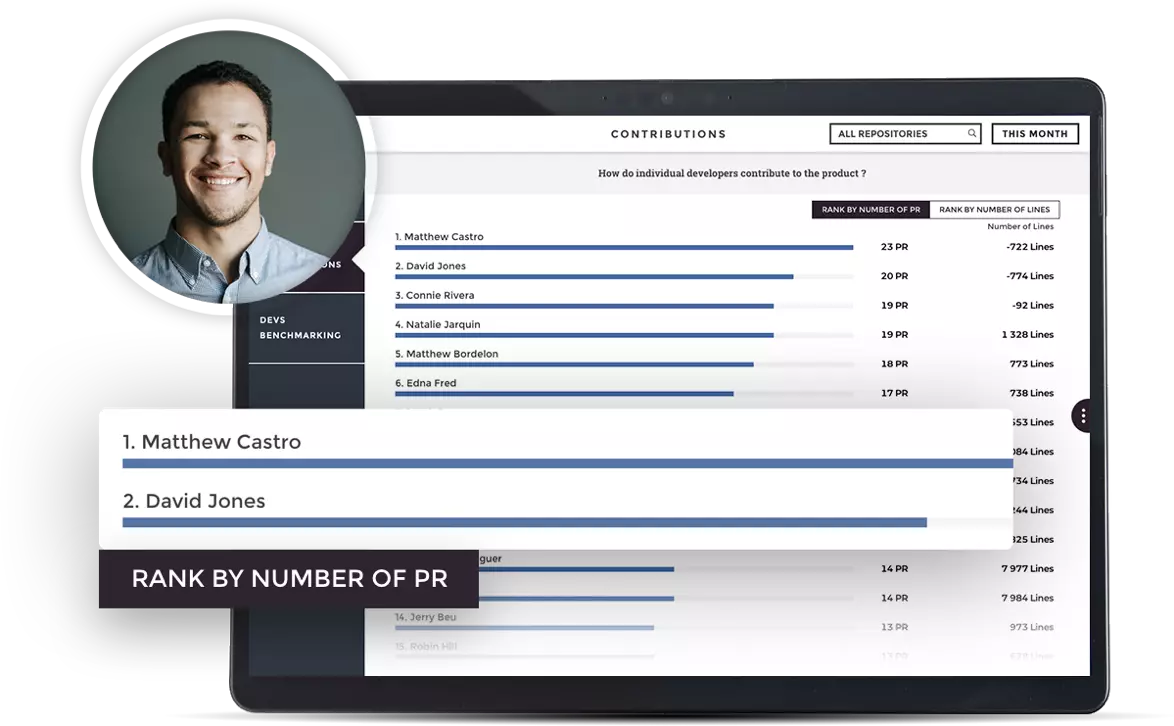

See how Dataneo, a customer of Toucan successfully implemented the recurring revenue model.

The Pros and Cons of Recurring revenue

The biggest pro is (recurring revenue), but there are many other reasons why recurring revenue streams can help your agency grow. Unfortunately, recurring revenue streams are not all positive. Some services require constant management and a lot of time. So let's take a look at some of the pros and cons of recurring revenue.

Pro 1: Extra free time

Time is money. You can do more projects and spend more time prospecting for new clients if you have more spare time. You can free up more time when you have recurring revenue. Let me explain.

If you earn $100,000 in revenue every year, but half of it is recurring, that means 50% of your total annual revenue is on autopilot.

With consistent cash flow, you won't have to worry as much about cash flow, and your staff can more freely spend their time developing new products and testing new marketing strategies instead of chasing new clients.

Pro 2: Stability of the business

You can ensure the stability of your agency by establishing a recurring revenue stream. It will streamline everything from budgeting to securing loans for your business. Potential investors and lenders will view recurring revenue streams as a safer investment if you plan on expanding at any time in the future.

Monthly costs are clear: salaries, loans, and accounts payable. However, there are many unforeseen expenses. With recurring revenue streams, managing all the stress will become a lot easier.

Con 1: Services that need updates

Not all recurring revenue services are created equal. Here are a few services that require a lot of effort from you, which will increase your workload.

- Provide daily updates for their social media channels

- Constantly manage and create advertisements on social media platforms

- Manage their presence across channels like Facebook, LinkedIn, and Twitter

You must keep an eye on them 24 hours a day. In the absence of a system, or if you haven't invested in a social media management platform, this revenue stream may become an issue.The return from poorly managed revenue streams is often not worth the effort. Inherently, ongoing work presents a greater challenge to plan, manage, and assign.

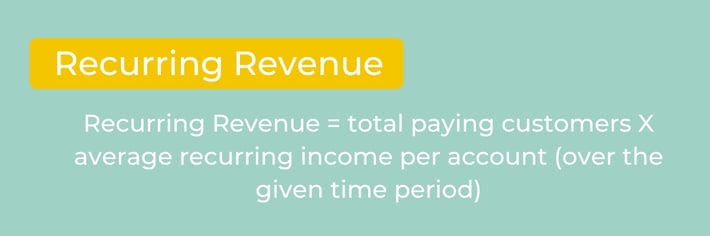

How to calculate recurring revenue

Though the way in which organizations calculate recurring revenue will change from use-case to use-case, the calculation is standardized in the sense that it is always comprised of the overall number of paying customers and the average revenue per customer. Here’s an example of what that formula might look like:

UnderstanDing recurring revenue

It’s probably obvious that everyone, from employees to investors, will pay close attention to a business's revenue as an indicator of performance, potential, and a litany of other important things.

Revenue, however, consists of both recurring revenue and the one-off sales that we touched on earlier, and recurring revenue is often particularly (if not more) important as it is a better indication of whether a company will be able to maintain consistent growth, profitability and, ultimately, long-term success.

Recurring revenue, especially from an investment perspective, is therefore highly desirable. Recurring revenue can come in many different forms and varies from company to company, and especially so from industry to industry.

In the SaaS industry, for example, recurring revenue can come from customers who subscribe to a service in the form of long-term contracts that are renewed or increased annually. Companies with these set-ups are able to confidently record future revenues because of the legally-binding nature of those contracts. While those revenues aren’t guaranteed per se, they’re highly likely to be incurred. So, while cancellation and opt-out clauses are generally the norm, organizations are still able to forecast (with relative accuracy) how many of their customers will stay with them for the duration of their agreed-upon terms.

Other forms of recurring revenue include, but aren’t limited to:

- Rent: rental income from long-term rentals or leases

- Leasing: income from cars (or other vehicles), equipment, and the like

- Support contracts: income realized from contracts in, for example, the software industry where services are sold with things like support fees baked in as an additional, renewable cost

- Loyal customer bases: while this might not intuitively be recognized as a form of recurring revenue when companies (especially well-known brands) have a broad and loyal customer base, they often consider those with predictable purchase patterns to be recurring revenue. A good example of this would be Coca-Cola.

You can find more examples of types of recurring revenue in this article from Simplicable.

Switching to A Recurring Revenue Model

You're convinced that switching to a recurring revenue model will make your business more valuable. Furthermore, you've selected a subscription model that will fit your needs. Here are the exact steps to making the transition from lumpy revenue to a steady subscription stream:

Reinvent

You need to put in place a new set of processes so your team can run this new branch of your business on their own before you can remove yourself from day-to-day oversight.

Carefully plan out the new processes involved. Most subscription services aren't going to be too complex, since they are by definition self-running. Following this groundwork, make sure you brief your staff, form a team to manage the transition and implement the new systems.

Then you’re ready to take your new offer to the market.

Refine

Different types of subscription services offer different benefits to customers. What promises does your subscription offer make to customers?

- Convenience?

- Affordability?

- Security?

- Novelty and surprise?

- Curated expertise?

You should use this to define your brand's positioning, which in turn will drive your sales and marketing campaigns. This is why it's so important to get your subscription service's positioning right before you launch it.

Retain

When you switch to a subscription model, it's also crucial to keep your existing customers. Consider spending some time planning how you will inform them of the change.

Consider calling a few key clients to explain your thinking behind the transition. For the rest of your customers, a carefully crafted email will do. By providing all your existing customers with a discount on their first few month's subscriptions, you are sure to win them over to your new way of working, too.

You should do everything you can to reward your existing customers for their loyalty and keep them on your side as if you get them hooked on your subscription offer, they're more likely to stick around on a long-term basis.

Invest

After you switch to subscriptions, you should heavily invest in customer service. In order to sustain long-term relationships with your clientele, you will have to provide excellent customer service. This is going to be a significant change in your approach to customer communication if you're accustomed to attracting one-off customers. You should make it a priority to get this right.

It can be time-consuming and challenging to calculate, track, and monitor your subscription revenue over time, but it can be very valuable in determining whether sales, customer retention, and outreach efforts are having the desired result.

This data may make it difficult for you to identify opportunities for growth or improvement, and it may also make it difficult for you to attract prudent investors who want proof that your business model is in tip-top shape.

By using an efficient analytics solution and democratizing data, making it available to everyone, you help your organization become more agile and have the information that investors need to make informed decisions about your business.

.png)