What is Churn?

Customer churn is a KPI that measures the number of subscribed users (clients, contracts, bookings) that a business has lost over a period of time. Heavily discussed by subscription-based industries, this metric is also known as the rate of attrition.

Customer churn is typically expressed as a ratio (a 14% churn rate) but can also be expressed as a whole number (we churned 12,000 in June). Customer renewal and customer churn have an inverse relationship.

Therefore, if a finance professional states that a company has a 70% renewal rate, it has also experienced a 30% churn rate. Whereas a measure of customer churn measures the number of customers that your business loses, a renewal rate measures the number that stay.

How to use churn

Churn is used in finance departments for two main reasons:

- Customer Lifecycle estimates

- Revenue and profit projections

Firms will use the general churn rate when disclosing metrics to shareholders or the general public, which is valuable to interested parties outside of the firm's operational scope.

For employees and management inside the firm, financial departments employ a variety of churn metrics to benchmark against other competitors in that industry.

When utilizing more sophisticated churn metrics, businesses should clearly define their terms and measure them on a consistent basis. Especially in product management, the following churn metrics involving these factors are crucial for measuring success:

- Products

- Sales Cycle

- Market segments

- Promotions

- Customer size

- Contract size

These factors all contribute to specific churn metrics that can provide all members of management with a clear snapshot of your firm's product performance in the market.

When Is Customer Churned?

The first step to measuring customer churn is determining the period during which a customer is to be considered churned. There is no specified time frame to measure churn rate, but finding the churn period of competitors can serve as a useful benchmark.

These are the common methods of determining the period of churn:

- When notification of cancellation is given

- On the specified end date of the subscription

- The day you know a customer will churn (ex. a failure to pay)

For finance professionals using Customer Lifetime Value to measure churn, the method for determining the churn period is much easier. A customer is churned when their reportable recurring revenue stream goes to zero.

How to Reduce Customer Churn

There are multiple questions that need to be answered in order to decrease customer churn:

- Why Are You Losing Your Customers?

To decrease churn, the first step is to identify the problem. Is your product outdated? Is a competitor offering a lower-priced alternative? The reason for leaving customers is crucial and may offer additional insights into other shortcomings or strengths. A great way to gauge the reason for churn is by sending satisfaction surveys to canceling customers.

- Are You Providing Excellent Customer Service?

In many cases, customers may rather cancel a service than ask for help if they feel that they have no chance of resolving issues through customer service channels. If you know this is the case, you must work to strengthen shortcomings in this area. Some ways to do this are creating FAQ pages, a more robust onboarding process, and adding personalization to your team.

- Are You Reading the Room?

It is usually evident when a customer is dissatisfied with a product. At times, customers may be logged out for weeks, or reaching out to customer service for longer periods of time. Work proactively and reach out to these customers before they decide to cancel.

Why Analyzing Your Churn is Important

There is a sole reason for a large focus on churn: it is more profitable to retain an existing customer than it is to attain a new one.

A lower churn rate or a lower churn rate indicates that your business is operating well or improving in lower its customer acquisition cost. This is the main reason businesses keep a constant pulse on churn. As a business hits its churn goals, it can use the metric to benchmark against competition and create insights into other areas of the business.

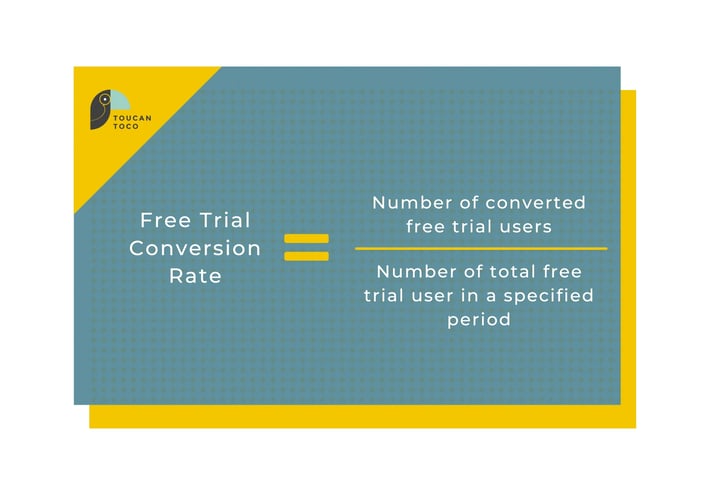

How to Calculate Customer Churn

To calculate your business’s customer churn rate, take your business’s monthly recurring revenue (MRR) at the beginning of a business month and divide it by the monthly recurring revenue you lost over the course of that month. Then subtract it by any upsells or additional revenue generated from existing customers. The formula for churn is as follows:

Customer churn rate = [(customers at beginning of the month – customers at end of the month) / (customers at beginning of the month)]

Here are the most common KPIs for finance departments tracking more intensive churn metrics:

- Customer and Logo Churn

This KPI measures canceling customers. Customer Churn measured as a percentage is an important part of the overall Customer Lifetime Value calculation process. - Recurring Revenue (ARR/MRR) Churn: Typically expressed as a ratio of ARR or MRR lost as a percentage of renewals candidates, but can also be expressed as the total MRR or ARR value lost to customer cancellations and attrition.

- Revenue Churn: GAAP revenue, MRR or ARR churn, is typically reported as a ratio. This metric is slightly broader than recurring revenue churn.

- Average Recurring Revenue Churn: Typically expressed as the average amount of average recurring revenue or monthly recurring revenue decrease due to lost customers.

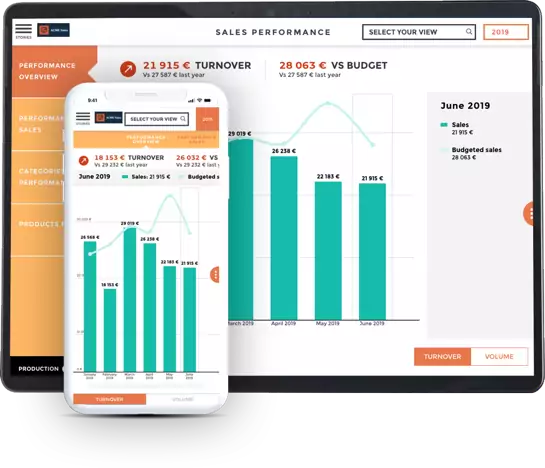

The Solution to Tracking Churn

As we discussed, churn is a crucial financial aspect of any subscription-oriented business. This model is gaining traction among the world's most successful companies who are driving their growth efforts with the most effective data analytics tools.

A tool like Toucan can help guide your churn insights and take your subscriber insights to the next level. By updating dashboards in real-time, Toucan helps finance managers can gain a deeper understanding of their Customer Lifetime Value, the efficacy of their products, and customer service performance.